Analyse Which of the Following Is Not a Product Cost

Which of the following is NOT one of the steps in price analysis. Conversely if a company overestimates the cost of producing a good or service it may be uncompetitive in the market.

Dumping Meaning Types Benefits Conditions And More Learn Accounting Economics Lessons Business And Economics

Which of the following is not a product cost.

. Parts used in the production of an automobile B. View the full answer. QUESTIONS Which of the following is not a product cost under full-absorption costing.

These include the cost of material labor etc. 4 Which of the following items is NOT an assumption of CVP analysis. Product cost refers to the costs incurred to create a product.

Involved in the production of the commodity. A Direct material indirect material and labor. The electricity cost of the office of factory foreman The cost of shipping finished products to customers.

Which of the following is not a reason to classify costs as either product or period costs. The cost of the product does not include the cost of selling it. D Indirect material indirect labor and overhead.

If a company underestimates the cost of producing a good or service it may sell them at a loss. The cost of shipping finished products to customers d. Repairs on manufacturing equipment d.

Steel used in inventory items produced. These costs include direct labor direct materials consumable production supplies and factory overhead. Salaries paid to the top management in the company d.

C Direct material direct labor and overhead. Convert each to percent of change so that you can compare them D. Rent for warehouse used to store current direct materials c.

The cost of selling. In the situation of multiple cost. Product M sells for 12 and has variable costs of 6.

Which of the following would not be considered product costs. Property taxes on plant facilities is an indirect product cost. Call your supplier and discuss changes in costs E.

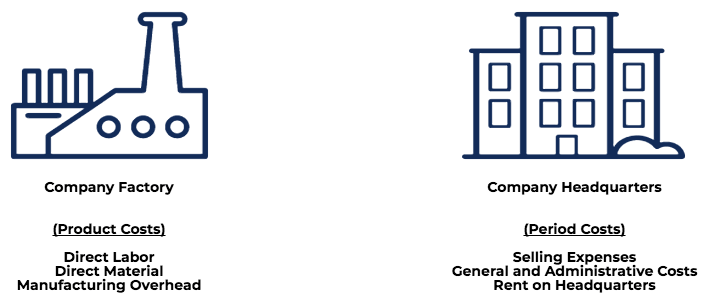

The expenses that are not related to manufacturing a finished product or are incurred outside of the production facility should not be considered as product costs for example selling general and administrative selling general and administrative selling general and administrative sga expense includes all the expenses incurred in the. Which of the following would not be considered an inventoriable product cost under an absorption costing approach to product costing. Answer of the quizzes.

Wages paid to assembly line workers D. Multiple Choice Sales commissions Direct labor Direct materials Variable manufacturing overhead Expert Answer 100 1 rating Products cost are the cost that directly goods into the making of a product like material labour indirect ma. B Material direct labor and indirect labor.

A Total costs can be divided into a fixed component and a component that is variable with respect to the level of output. Depreciation on the plant installed in the factory b. It is important to accurately calculate product costs because they can impact pricing decisions and profitability.

Direct materials costs Selling costs Direct labor costs Factory overhead costs Selling costs -Product expenses are capitalized expenses which are included in the amount of inventory. In the latter case product cost should include all costs related to a service such as compensation. If total warehousing cost for the year amounts to 350000 and 40 per cent.

Vacation pay accrued for the production workers e. Prime cost in broad sense is the combination of all the cost associated with the cost of production with exception to the fixed cost. B When graphed total costs curve upward.

Which of the following costs is not a product cost. Thus the correct answer is. The electricity cost of the office of factory foreman c.

Which of the following costs is NOT a product cost. Electricity bill for a manufacturing facility E. To determine unit manufacturing costs B.

The cost of fuel used in the factory. Product cost can also be considered the cost of the labor required to deliver a service to a customer. Product W sells for 15 and has variable costs of 10.

Which of the following is not a factor in cost-volume-profit analysis. Accounting questions and answers. Twin predicted sales of 25000 units of M and 20000 of W.

See the answer Which of the following is not a product cost. To analyze costs for control purposes D. Salary of a factory supervisor C.

Rent on an office building b. A Factory Supervisor Salary B Direct Labor C Indirect Materials D Direct Materials E All of the above would be. To determine if the costs are fixed or variable C.

Find a benchmark database B. Depreciation on the plant installed in the factory. Direct materials used in the current period b.

C The unit-selling price is known and constant. Product costs includes all the costs that goes up in the production of that product it includes direct labour costsdirect material costs and factory overheads too. 1 point a.

Obtain internal data C. To report production costs on the income statement. The cost of fuel used in the factory.

The three components of product cost include. Fixed costs are 60000 per month. Which of the following costs is not a period cost.

Which of the following costs is not a product cost. Property taxes on plant facilities.

Exw Ex Works Meaning Pros Cons And More In 2022 Financial Management Accounting And Finance It Works

Product Costs Types Of Costs Examples Materials Labor Overhead

Cost Behavior Meaning Importance Types And More Bookkeeping Business Accounting Education Financial Management

No comments for "Analyse Which of the Following Is Not a Product Cost"

Post a Comment